Here is a review of my 12 year experiment with Zopa; the good, the bad an the ugly.

One of the comments or criticisms I hear about P2P lending is that it’s not been testing during a recession, so it might be riskier than it appears.

However, I’ve been investing in P2P from 2007 to the present day and definitely learnt a bit about it and saw how it coped with the 2008 crisis and the aftermath.

First of all: What is P2P investing?

P2P (or Peer-to-Peer) investing or lending is where you (a Peer) lend your money to someone else (another Peer), typically through an intermediary/platform meaning that you have a contract to have your money returned (with interest) akin to a typical loan. As I’ve said before, lending money to people who need it is not really a good idea but people nee to borrow don’t they?

How I got involved?

Back in 2006, I got reading about the coming wave of financial innovation that was just around the corner. The business of a bank was to take in savers money and pay 1% interest and lend that money out on loans to people/business for 10%. The bank collects the difference between the two and gets rich. Poor savers are shafted and borrowers are paying for the banks champagne parties. I felt strongly enough about this to put my own money at risk and I still have a tab on my Accounts spreadsheet called “Social Lending” for all my P2P investments/follies.

The first company that I invested with was ZOPA which originally meant Zone of Possible Agreement or ZOPA – meaning that if savers would be happy with more than 1% and borrowers with less than 10% there was a zone where a deal could be done. The interest rates for lending were around 8-10% but fluctuated as the relatively demands for lending/borrowing shifted. You could adjust your own lending to any rate you’d like – but obviously expect too high a rate and you might never lend anything, go too low and you’ll get poorer returns. Many borrowers were refinancing credit cards and even a usurious £15% would be an improvement (but more on that later) Lenders were categorised into A+, A, B, C (and later D, E) with higher rates (and default rates) for riskier loans. ZOPA mentioned how diversification was very important (but I didn’t pay too much attention).

I dipped my toe in and found that the rates of return were good and aimed to generate about £200 a month in interest from ZOPA with an aim for around £20k invested. This was about 20% of my investable assets at the time. Potential returns were greater than my mortgage at the time and it seemed like a neat way to put my money to good use. I have a riskier attitude to investing and felt that investing to less creditworthy borrowers for longer periods of time would give me better returns. And the rates on offer were spectacular – sometimes 15%+, would wouldn’t be tempted

Feeling Lucky? Double Down!

Besides lending blindly into the market, ZOPA had a fun marketplace called “Listings” here borrowers took a chance to beg directly for your money – they’d detail out their income/outgoings, what they were borrowing for and so on. A reverse auction then ran to fill the loan. It could mean that someone borrowing £10,000 for a car could accept a loan at a rate of 10% but some borrowers could have bid 5% and others 15%. I loved it (in part due to having the time at work to waste) and I was able to use a bit of simple programming to allow me to big direct from a work-looking spreadsheet. Soon, my portfolio was full of chunks of these listing loans, upping from a max of £50 to hundreds (in my wisdom). I reinvested loans that were repaid and put fresh money in and things were looking great! Certainly, the stock markets at the time were in turmoil and I was concerned about the risks of borrowers not repaying – but I was getting 1% a month! Why would you stop now when you are making it big!

Return of Capital is more important than Return on Capital

A wise person once said

Investing good money after bad

With hundreds and thousands of loans in place, keeping a track of all this lending meant having a spreadsheet to do a monthly calculation. One thing that I noticed was the a lot of (good) borrowers were repaying early and some (bad) borrowers were repaying late or were becoming bad debts. If you relend your money returned from good borrowers you could quickly end up with a loan book full of bad debts and lates.

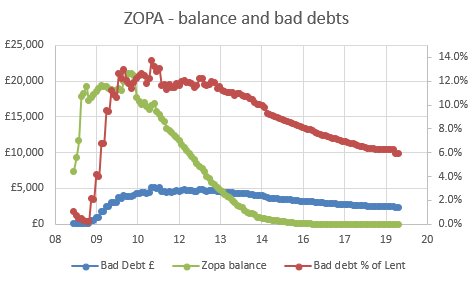

Not for widows and orphans

At its peak, my bad debts were 14% of the total amount of money I’d lent on ZOPA. That is a phenomenally terrible performance and it is nothing to boast about. The bad debts were gradually paid off over time and they now sit at about 6% – which is still let’s face it shit but a lot better than 14%. I still have over £2000 in bad debt but recently ZOPA sold off my bad debt loan book and I received over £100 from the deal. That was a result for me as I have nothing booked for future ZOPA income and bad debt repayments have only been about £2 a month for the last year. It also closes the chapter on my ZOPA investment. In total I deposited about £25,000 and withdrew about £31,000 over 12 years – quite a case history.

Looking back

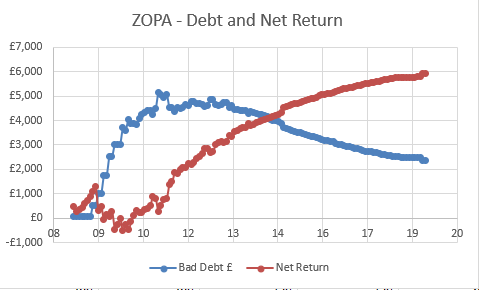

My bad debt and net return results are in the graph below. Initially in 2008, my return increased but soon late payers were cutting my returns – but I was blinded by that due to more money being pumped in and notes from the borrowers saying that they intended to pay but their dog ate the direct debit. How naive I (and ZOPA were).

I stopped investing new money after about 2011 as the bad debts started to rise. But since most of my loans were over 3-5 years or late, repayments continued for years to come (and as of July 2019 are still coming despite 9 years of no new lending). This period of not lending more money and waiting for your money to come back is called “drawdown” and you can see that as my balance dropped from 2010 onwards, I was effectively in drawdown. By about 2014 I had effectively no money left in ZOPA but bad debts continued to be repaid up to the present day.

Ironically, it was not until I stopped investing more money that I managed to start making money. Overall my total return (after tax) was just shy of £6000. The IRR was actually pretty respectable 7.65%. I’ve only just calculated that now and I’m astounded as for a long time I was losing money and I always thought that ZOPA was a folly.

To put things into perspective, the most I ever had invested was about £20,000 and in total I lent out about £40,000 meaning £20,000 was reinvested. My bad debts peaked at about £5,000, declining to £2,500 and net return (including tax and bad debts) was £6,000.

Experience is simply the name we give to our mistakes

Oscar Wilde

Would I invest in ZOPA again?

The easy answer to this is Yes. You can get more information at places like here but from what I’ve read, the underwriting of loans has been tightened up, at the same time as the rates have come down to around 5%. You can also open an IFISA to avoid paying tax on your returns.

The platform is easy to use and the system of who you lend to is simplified with less selection of what rates to use and how much to lend. That’s a great step forward as I don’t have the time to invest in learning a new platform.

If you are thinking of investing in ZOPA there is a promotion at the moment whereby if you use this link and invest £2,000 we’ll both get £100 as a reward. This is effectively a 5% bonus on your lending and makes it comparable to what you get using an Amex card – but at least this way your money is invested and not spent.

I’ll look at the Ts&Cs and see if I can have the Lady open an account with ZOPA so that we can both benefit, £100 each would be nice. She’s not that keen an investor, so she may take some convincing.

Alternatives to ZOPA

There are a huge number of P2P sites out there. I don’t have any interest in learning the pros and cons of each one. I use 5 in total; ZOPA, RateSetter, Funding Circle, Abundance Investment and ThinCats. I would not recommend ThinCats but I would the others. They all have sign-up bonuses (except Abundance) which you can benefit from (and me).

Overall view of P2P investing

From the early Wild West days of pre-crisis to the current day, the industry has grown, developed and matured. I think that personally, if I had never have got into P2P it would have been better for me and my finances and the amount of time involved can make it more of a hobby than a pure investment.

But as a way of increasing returns vs. cash/bonds and as a bit of diversification from pure shares P2P has a place in more adventurous portfolios. It’s not suitable for those who want no-risk of capital loss.There’s also the benefit of being able to lend money now and receive repayments in the future, useful for cash flow balancing for FIREes.

Thanks & good luck, GFF

Would you do it once you’ve retired?

LikeLike

I think so – it’s a useful place to put money with the expectation you can get monthly payments fir up to 5 years – it’s also easy to use and a good to use up either your £1000 savings allowance or indeed your IFISA allowance.

LikeLike

I agree 7.65% IRR is pretty respectable over the period 2007 to 2019. I’d be interested in the IRR from 2008 to 2014 as that was the main period when you were invested. With hindsight equities would likely have been better.

Currently I think there are better options in high yield funds invested in property, bonds and equities if seeking a 5%+ yield.

LikeLike

I’m not a fan of selling down investments to make up for cashflow shortages, so I find the repayment of P2P loans quite useful – so there’s more than just yield in question.

My P2P lending has an IRR of around 8%

overall from 2007 to the present day. And that includes some heavy bad debts on one platform that might come good (fingers crossed).

Just looking alone at ZOPA doesn’t give the full picture but from 2008 to 2014 was less than 5%! A shit performance – but that includes the bad debts that later got repaid (some of them anyway).

LikeLike

Thanks for the extra information. It’s good that the overall result for you has now risen to 7.65%.

LikeLike

the exact number is shrouded in mystery as I lost my expenses speadsheet back in 2008 – losing 7 years of figure.

LikeLike